Because rebuilding your credit shouldn’t feel like rocket science—or a lifetime sentence.

December 2026

So you’ve been denied an apartment, ghosted by lenders, or had your card app hit with a “thanks but no thanks”? Been there.

Bad credit can feel like quicksand — but with the right hacks, you can climb out fast.

This week on Credit-Hacks.com, we’re dropping a 7-step plan to take your score from trash to 🔥. Whether you're starting in the 400s or just need to push past 650, this is how you bounce back in 2026.

📦 Today’s Stack:

📊 Pull + Scan Your Report

🧽 Scrub the Negative Marks

💳 Master Utilization

🙋🏽♂️ Piggyback Smarter

🛑 Stop Killing Your Score

📊 1. Check Yourself (Before You Wreck Yourself)

You can’t fix what you don’t face.

Start by pulling your full credit report from AnnualCreditReport.com — the only official free source.

🔍 What to check:

Wrong names, outdated addresses, or shady phone numbers

Duplicate debts or balances that don’t match

Closed accounts showing as open

Late payments you know were on time

💡 Tools to use:

Credit Karma (for quick TransUnion/Equifax peeks)

MyFICO (paid, but lender-accurate)

🧽 2. Clean the Crap

Errors = score killers.

Thanks to the Fair Credit Reporting Act, you can challenge anything that’s inaccurate or unverifiable.

📌 Dispute options:

Online (faster, but fewer protections)

By letter (slower, but stronger legally)

🛠 Tip: Dispute everything — collections, wrong balances, charge-offs, false late payments. Even one fix can boost your score by 20–100 points.

📎 Pro Tip:

If it’s NOT an error but still bad (like legit collections), try:

Goodwill letters

Pay-for-delete negotiations

Or hold off unless you must clear them for a mortgage.

💳 3. Become a Utilization Ninja

Utilization = how much of your available credit you’re using.

This accounts for 30% of your score. The magic number? Under 10% — but under 30% is the minimum goal.

🎯 Five ways to lower utilization:

Pay down cards — using snowball or avalanche methods

Pay before the statement closing date, not just the due date

Make multiple payments mid-cycle

Ask for a credit limit increase (just check if it’s a soft or hard pull)

Use installment loans to consolidate revolving debt

📉 Installment loans lower your utilization impact and often save you interest.

Want a fast score boost? Hitch a ride on someone else’s stellar credit.

👯♀️ The Hack:

Have a friend/family member add you as an authorized user on their credit card.

💪 What to look for:

2+ years of credit history

$5K+ limit

No lates, low balance

🎯 You don’t need access to the card — you just need to be listed.

💸 BONUS: You can buy “trade lines” from third parties (but do your homework). They’re expensive, temporary, and work best when your report is already fairly clean.

🛑 5. Stop Shooting Yourself in the Foot

The #1 silent killer of your score? Unnecessary credit applications.

Every hard inquiry drops your score by a few points — and too many in a short time screams “desperate” to lenders. Plus, new accounts shorten your average credit age.

🧠 When to apply for new credit:

You’re building a thin profile

You’re consolidating debt

You're getting real long-term benefits (low APR, rewards)

📆 Space your apps 3–6 months apart and monitor inquiries like a hawk.

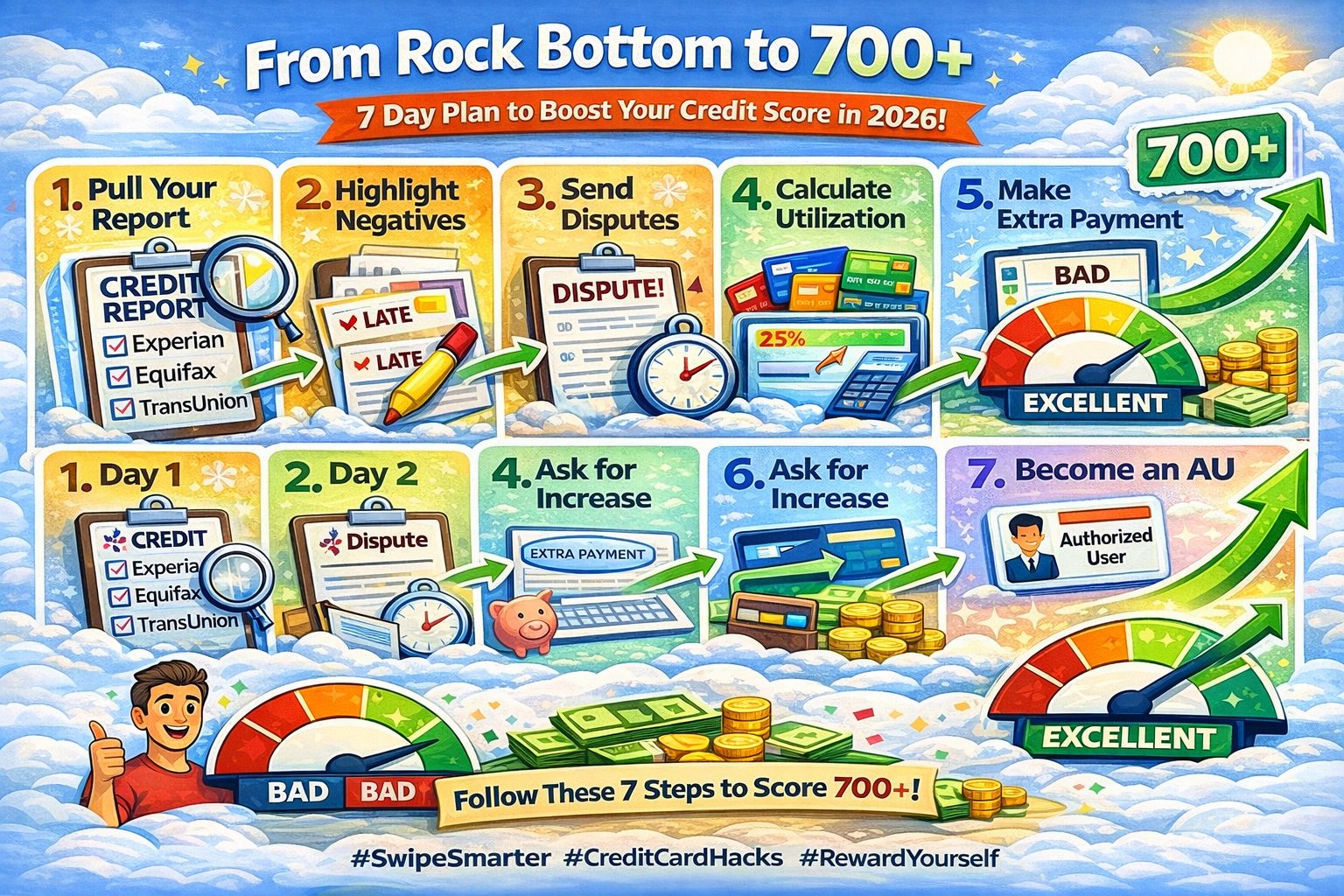

🏁 The 7-Day Game Plan

Here’s how to rebuild smarter, not harder:

Day 1: Pull your full credit report

Day 2: Highlight every negative mark

Day 3: Send dispute letters

Day 4: Calculate your current utilization

Day 5: Make an extra credit card payment

Day 6: Ask for a limit increase

Day 7: Look for authorized user opportunities

⏱️ One hour per day = major momentum.

🎨 Visual Breakdown Incoming

Creating a clean, 16:9 vector infographic of the “7-Day Plan to 700+” right now — includes icons for each day’s task with pastel backgrounds and arrows connecting each move.

🔖 #Hashtag That Score Boost

#CreditRebuild

#ScoreGoals

#From400To700

#FixYourCredit

#UtilizationHack

#GoodCreditMoves

#DIYCreditFix

#PaySmartPlaySmart

#AuthorizedUserBoost

#CreditHacks2026